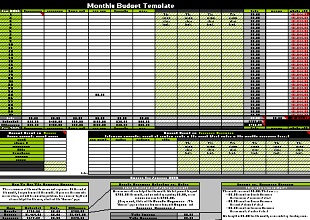

Download these 20+ Free Monthly Budget Templates in MS Excel format to assist you in preparing your own Budget easily and effectively.

Running your home is not easy because you have to fulfill the needs of all family members within your budget. It is really very hard to keep them happy every time. Although it is difficult to keep all people happy it is not impossible. With a little bit of planning, you can do this effectively. You have to plan for the monthly home budget in order to make sure that all desires of your family are fulfilled without taking any debt.

You have to plan your home budget effectively by considering the finances and the needs of all members of your family. With an effective budget, you can easily plan for your future events such as the education of your children, retirement plans, and the wedding of your daughter. A well-designed monthly home budget will help you to achieve your short-term goals. You can easily pay off your debt and deal with unforeseen emergencies.

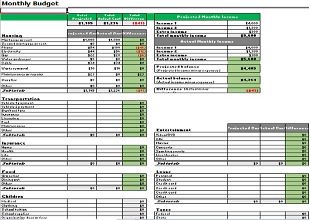

Free Monthly Budget Templates

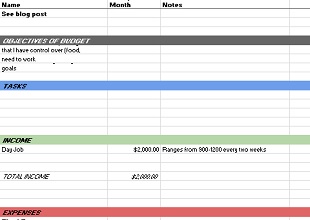

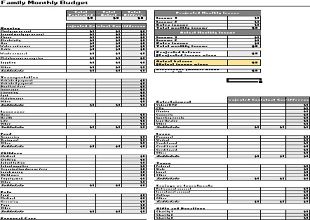

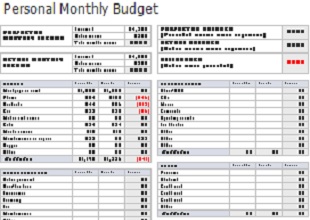

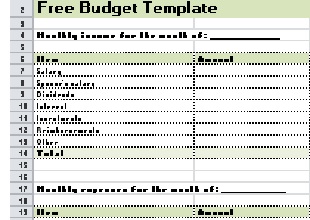

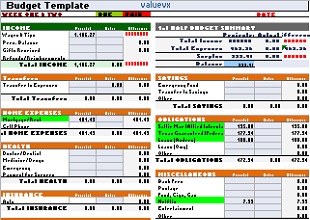

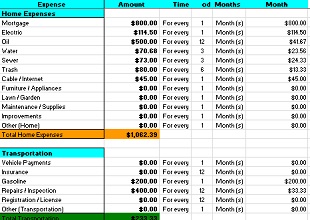

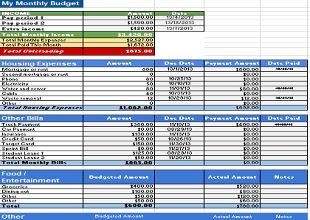

Here is a preview of this Monthly Budget Planning Template,

Monthly Home Budget Format Guidelines

A perfect monthly home budget can increase your monthly savings and enable you to shop for different festivals without any trouble. In order to make your work easy, I am going to share some tips for designing a monthly home budget:

Budget as Plan to Action:

The budget provides you with a plan of action to deal with money shortage problems and enables you to manage your money in an effective way. You can easily project your monthly expenses and income in a way to save some amount also. Saving is necessary in order to deal with sudden expenses such as illness, accident, or any kind of repair.

Bills in Monthly Budget:

Start your monthly home budget planning by collecting your all utility bills, receipts, and paycheck stubs. It is not necessary to have proper budget planning software because you can easily do your work in Excel Sheet on your computer. If you do not want to use computer software then you can simply use a notebook or pencil.

Fixed Expenses in Monthly Budget:

Prepare a comprehensive list of your monthly expenses and include all those expenses that are fixed to pay each month such as rent payments, household utility bills, and insurance payments. Cell phone, credit card bills, or any other expense that you have to pay each month should be included in this list.

Entertainment Expenses in Monthly Budget:

After determining expenses, it is time to estimate entertainment costs, child care or tuition fees, groceries, and other items that are necessary to purchase each month. Your list should contain regular expenses such as lunch money and the cost of gas. In short, you have to consider each and every expense in order to determine the regular cost of living.

Income Sources and Monthly Budget:

Now prepare another list to state your income sources in order to estimate your total monthly income. It will help you to allocate a specific amount to each category according to its urgency and needs.

Subtract the total amount of expenses from your income to determine whether you are in the position to save some amount or to reconsider your monthly budget. If you get a negative figure then it is necessary to evaluate your budget again. You can cut some unimportant expenses or those activities that can be postponed to next month.

Have a savings account to deposit a fixed amount every month to meet sudden emergencies.