You may have taken loans for different purposes, like purchasing a house, starting your business, or sending your child abroad to study. Whatever the purpose, if you have taken more than one loan, you will have to juggle the equated monthly installment of all the loans against your income and day-to-day expenses. Not paying one or more loan installments is not a solution because that will only increase the burden in the future. What you need to do is prepare a loan payment schedule which will help you keep track of and manage your loans.

Understand the Loan and Equated Monthly Installment

Generally speaking, there are 2 types of equated monthly installments:

- Even Principal Payments: Where the amount of principal payment is the same in each equated monthly installment.

- Even Total Payments: Where the interest decreases as part of the loan is repaid.

In one case the amount of equated monthly installment decreases over the years while in the other it remains the same. You may have one or both types of installments.

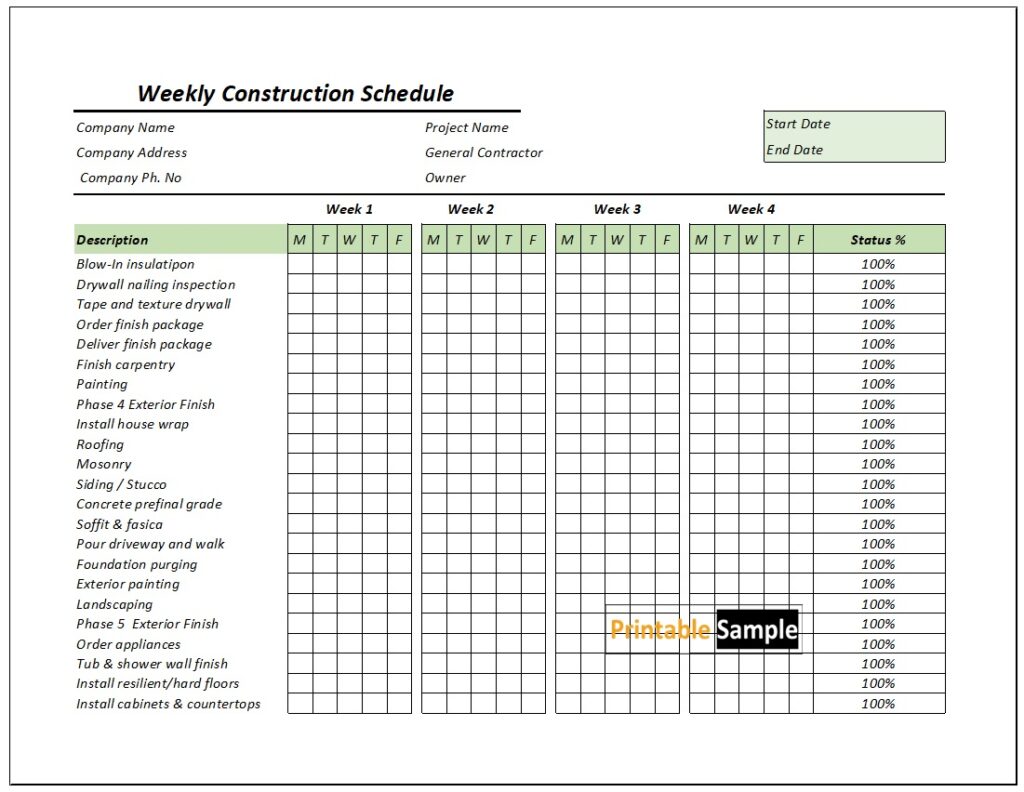

Here is a preview of this Free Loan Payment Schedule Template created using MS Excel,

Assess Your Position

When you write your loan repayment schedule, you will need to sit down and asses your position. You will need to understand

- the total amount of unpaid loans,

- the type of equated monthly installment for each loan

- your current and future income,

- your current and future expenses,

- your provision for emergencies.

Based on these facts you will have to work out a strategy to manage your personal expenses while at the same time continue repaying the loan.

Strategy

Once you know where you stand, you can devise a strategy for repayment of your loan and reducing your outgo. You can adopt one of two methods:

- top-down or

- bottom to top.

The top-down approach aims at reducing your debt quickly by paying off the bigger loans first through increased equated monthly installments and then taking care of the rest in smaller installments.

The bottom-to-top approach is one in which you pay off the smaller loans first and then gradually pay off the bigger loans.

You can even take a fresh single loan to pay off all the earlier loans. That way you have only one loan to pay off. You might even get a reduced equated monthly installment.

Credit Card Consolidation

If you have more than one credit card, you can consolidate all your credit cards into one which carries a low rate of interest. This reduces the outgo from your income. You can also pay off the outstanding amounts on some of your credit cards and keep the rest until they are completely paid off.

Whatever strategy you adopt for the reduction of your loan amount, you will have to draw up a schedule detailing the strategy with dates for repayment of various loans, the monthly outgo against the loan, your daily expenditure, and your income.

Also, note down the balance yet to be repaid, and strike off each one as it is repaid in full. Talking to a professional debt consolidator can help you get a better perspective.