A Check Voucher is a combination of a check and a voucher. It is also known as remittance advice, the voucher gives the details of the reasons for the payment of the check by the issuer. The person receiving the check separates the voucher and keeps it for record-keeping before cashing the check.

A check voucher is a kind of check that is connected to a stub that describes the objective of the check, the contents and material of the check, or both. These types of checks are often used to simplify or further improve the record-keeping systems for the individuals or organizations that issue the checks, as well as the individuals or organizations that receive the checks. Before a voucher check is deposited, the stub is removed and registered. Just as there are various accounting systems, there are also various techniques in which these checks may appear. In some circumstances, they come in the form of a full sheet of paper with the check at the top section of the paper and the voucher on a detachable section of the paper below.

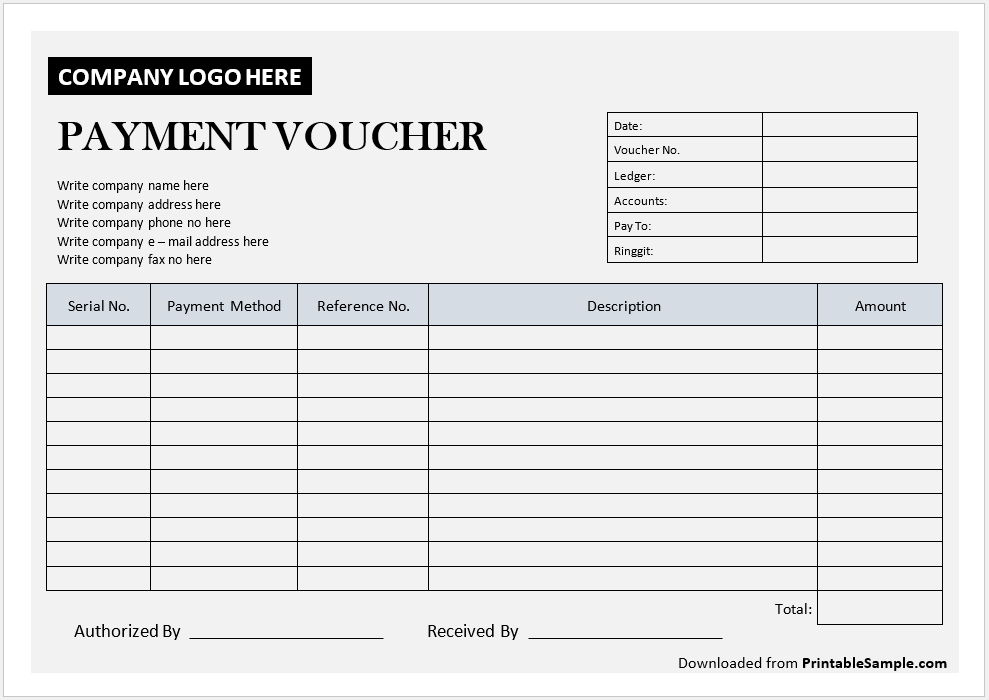

Here is a preview of a Free Sample Check Voucher Template created using MS Word,

Here is the download link for this Check Voucher Template in MS Word format.

Contents Of Cash Voucher

- Check Number

- Descriptions

- Amounts for several accounts payable invoices

- Date

Usage Of Check Vouchers

A number of organizations use the check voucher technique for their payroll processing. According to this kind of system, an employee who received a check voucher will be provided with not only the details about services given or the number of hours worked but she will also be provided with information about taxes that have been subtracted and any other withholding if present. This system not only lets employees review their previous tax income information but also evaluates how much of their earnings are being attributed to taxes and how those deductions are structured.

When a check voucher system is used in payroll applications, it also shows details about amounts that are being assigned to savings or retirement programs such as 401k programs. It also lets employees review any other voluntary and intentional deductions or withholding. Some companies also allow their employees to have a certain sum of money taken out of their paychecks in order to pay for or subsidize health insurance coverage policies or additional health insurance coverage policies. This type of information is usually detailed and described in a check voucher. One of the benefits of a voucher check is that it provides a record for both the issuer and the payee. It is a record that both parties can refer to in the case of a dispute or disagreement.

Some businesses have made a tradition of paying all of their employees with check vouchers, even if the employee receives their salary using a direct deposit service. In these circumstances, there is a check attached to the top of the voucher that is changed with a note or watermark. This note or watermark shows that the check is not for deposit and that the funds have already been transferred into the payee’s account.

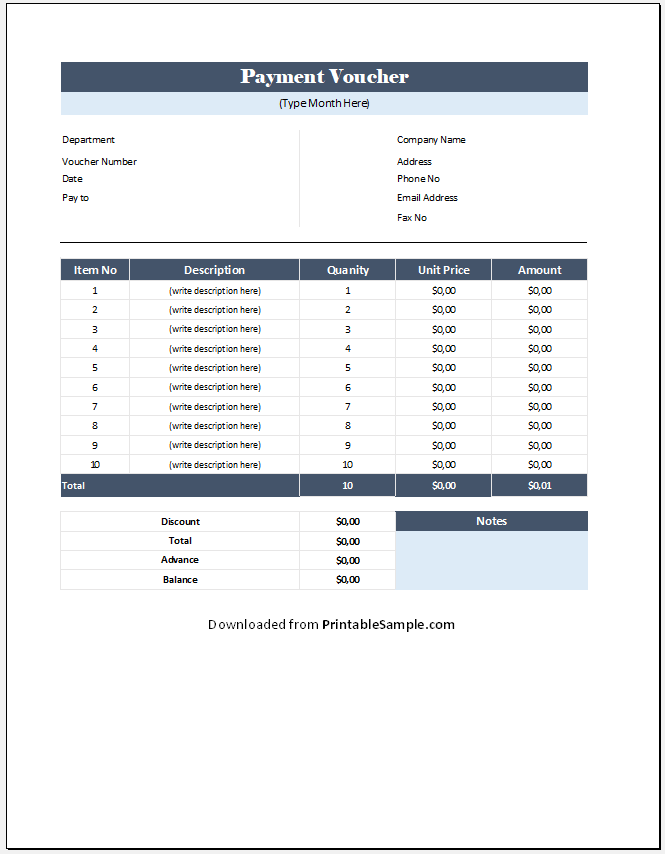

More Free Vouchers

More free Check Voucher Templates,

Still looking for more free vouchers? Check out the following.